Property Market Review – September 2021

Robust figures for commercial property market

Commercial property investment volumes reached £31.4bn at the end of July, according to the most recent UK Commercial Market in Minutes report from Savills. This was 32% above the same period in 2020 and 4% higher than the five-year average.

Savills also noted a promising rise in the three-month rolling total for investment volumes. The May-July 2021 reading of £16.1bn was a 38% increase on the previous three-month period. Industrial assets received the highest quantum of investment for the period measured. At £9.7bn, this equated to 31% of total investment, above its share (14%) in 2018.However, total investment for industrial assets remained 7% below the same period in 2018. Likewise, regional office investment volumes were 40% up on 2020 but 23% below their 2018 level.

An interesting trend highlighted in the report is the shifting pattern of affordable workspaces. Traditionally, cheaper fringe space has helped generate economic growth by providing space for new entrepreneurs and creatives. Over the last decade, however, the pattern has somewhat flipped. In London, office rents have risen sharply in cheaper locations; 53% in the fringe compared to 29% in the city core. As a result, the gap between core and fringe rents (previously 19%) has vanished. Indeed, by the end of 2020, fringe locations had nudged slightly ahead.

Return of workers sparks office space war

As firms start welcoming workers back to the office, footfall is increasing in city centres. This bodes well for the office sector, but commercial landlords still face several challenges.

Across UK high streets, footfall rose by 2.6% in the first week of September, according to data from Springboard. This was even higher in inner London, where footfall jumped by 4.1%.

Office space provider IWG reported a ‘very strong recovery‘, as occupancy rates bounced back. Similarly, property firm Derwent London said that rent collection had returned close to prepandemic levels with net rental income for the six months to the end of June rising to £90.1m from £84.4m in 2020.

This bounce-back looks set to provoke a “war for space“, according to Derwent boss Paul Williams. He thinks tenants now want “the right space, not just the cheapest space“, which perhaps spurred Derwent’s recent acquisition of two buildings in the ‘knowledge quarter’ on Euston Road and Tottenham Court Road.

IWG is adapting to the new environment by adding space outside London. Mark Dixon, IWG’s Founder and CEO, commented, “This fundamental shift in the way people work is clearly a positive tailwind and we are seeing increasing levels of interest from enterprises wishing to transform their working practices.”

Meanwhile, scrutiny is increasing over offices’ environmental impact, which is driving demand for greener offices. The upcoming UK energy efficiency standards will tighten regulation of commercial buildings’ energy performance from 2023.

| Industrial assets received the highest quantum of investment for the period measured. At £9.7bn, this equated to 31% of total investment, above its share (14%) in 2018. |

Commercial property currently for sale in the UK

- Regions with the highest number of commercial properties for sale currently are South West and North West England

- Northern Ireland currently has the lowest number of commercial properties for sale (27 properties)

- There are currently 1,324 commercial properties for sale in London, the average asking price is £1,543,108.

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,324 | £1,543,108 |

| South East England | 1,170 | £1,876,405 |

| East Midlands | 761 | £972,889 |

| East of England | 750 | £613,663 |

| North East England | 787 | £331,016 |

| North West England | 1,431 | £413,511 |

| South West England | 1,528 | £563,369 |

| West Midlands | 1,156 | £470,105 |

| Yorkshire and The Humber | 1,126 | £313,856 |

| Isle of Man | 53 | £485,081 |

| Scotland | 1,123 | £321,800 |

| Wales | 798 | £404,265 |

| Northern Ireland | 27 | £457,019 |

Source: Zoopla, data extracted 16 September 2021

Commercial property outlook

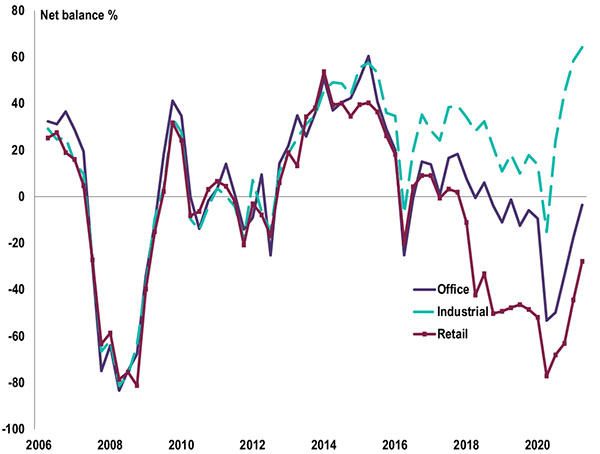

Investment enquiries – broken down by sector

- A net balance of +64% reported an increase in demand for industrial space

- This reading for industrial is the highest on record

- Retail and office sectors remain in negative territory at -28% and -4% respectively.

Source: RICS, UK Commercial Property Market Survey, Q2 2021

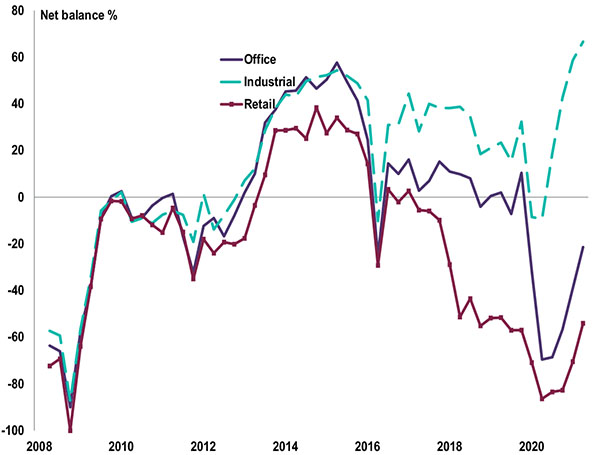

Capital value expectations – broken down by sector

- For the coming 12 months, strong industrial capital value growth is expected across the UK

- Prime and secondary retail values are still anticipated to see widespread declines, but less negative than previously

- In the office sector, prime values are now seen holding steady in the year to come, even if the outlook remains comfortably negative for secondary.

Source: RICS, UK Commercial Property Market Survey, Q2 2021

All details are correct at the time of writing (16 September 2021)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.